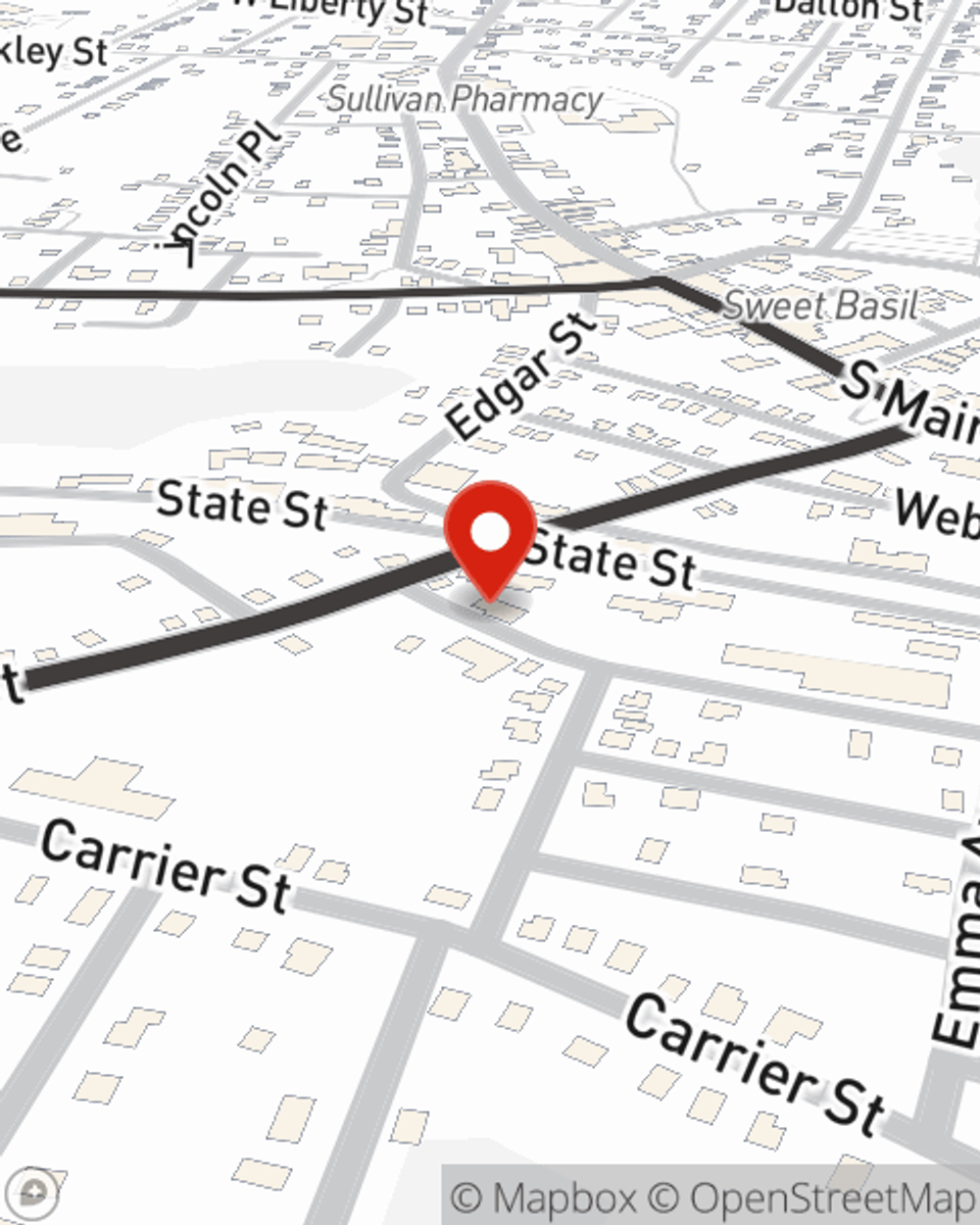

Life Insurance in and around Liberty

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- New York

- Sullivan County

- The Catskills

- Pennsylvania

- Monticello

- Ellenville

- Upstate New York

- The Hudson Valley

- Delaware County

- Ulster County

- Greene County

- Callicoon

- Loch Sheldrake

- Livingston Manor

- Parksville

- Phoenicia

- Hudson

- Catskill

- Saugerties

- Kingston

- Poughkeepsie

- Newburgh

- New Paltz

- Kerhonkson

Protect Those You Love Most

If you are young and a recent college graduate, it's the perfect time to talk with State Farm Agent Sam Loughlin about life insurance. That's because once you have a family, you'll want to be ready if tragedy strikes.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Put Those Worries To Rest

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific time frame coverage for a specific number of years or another coverage option, State Farm agent Sam Loughlin can help you with a policy that can help protect your loved ones.

Did you know that there's now a life insurance option available that's perfect for a person who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really be of good use when it comes to supplement the financial options for final expenses like medical bills or funeral costs. Don't let these expenses overwhelm your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Sam Loughlin and see how you can be there for your loved ones—no matter what

Have More Questions About Life Insurance?

Call Sam at (845) 292-5882 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Sam Loughlin

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.